In today’s fast-paced financial world, businesses must keep up with the latest technology to stay ahead of the competition. At Nityam Europe, we offer innovative software development services to help businesses streamline operations, reduce costs, and enhance the customer experience. Our state-of-the-art solutions empower businesses to tackle the unique challenges of the finance industry and boost their profitability. What makes us stand out in this industry is our customer centric approach and end-to-end solutions.

Some of the benefits of choosing nityam for your banking and finance software solutions requirement are:

Tailored software solutions to improve financial management and banking operations

Seamless payment integration for FinTech applications

Advanced analytics for data-driven decision making

Our Services

Banking Software Solutions

We develop custom banking software solutions that help businesses manage their financial operations, including account management, payment processing, and loan management.

Investment Software Solutions

Our investment software solutions help businesses manage their investments, portfolios, and trading operations. Our solutions offer real-time analytics, risk management, and trading automation.

Insurance software solutions

We develop custom insurance software solutions that help businesses manage their claims processing, policy management, and underwriting operations. Our solutions offer real-time visibility into claims data, fraud detection, and regulatory compliance.

Payment Processing Software Solutions

Our payment processing software solutions help businesses manage their payment processing operations, including payment gateway integration, fraud detection, and risk management.

Enhance your financial agility with our flexible and scalable solutions.

Our financial software development solutions come with a range of features that help businesses improve their financial operations, including

Real-time data analytics and reporting features that allow banks to make informed decisions quickly and efficiently.

Automation of workflows and processes, enabling banks to increase efficiency and reduce costs while minimizing the risk of errors.

Regulatory compliance management features to ensure that banks are always compliant with the latest regulations and standards.

Our software includes advanced risk management and fraud detection features to protect banks and their customers from fraudulent activities.

Our software integrates with leading payment gateways, enabling banks to offer a wide range of payment options to their customers.

We understand that businesses in the BFSI industry face a range of challenges in managing their operations, including:

We provide tailored solutions that address these challenges and help businesses improve their financial operations. Our solutions offer:

- Reduced operational costs.

- Enhanced regulatory compliance.

- Improved cybersecurity.

- Simplified workflows.

- Enhanced customer experience.

Why Nityam Europe?

Unlocking the Power of Logistics with Nityam Europe here are some reasons why you should choose us

We provide customized logistics software solutions that are tailored to meet the unique needs of each of our clients

Our software development process includes thorough testing and quality assurance to ensure that our solutions are of the highest quality.

We provide ongoing support to our clients to ensure that their software solutions are running smoothly and that any issues are resolved quickly

We provide cost-effective logistics software development services that are affordable for businesses of all sizes.

Check out our work

Here are some of our case studies of work for the banking and finance industry

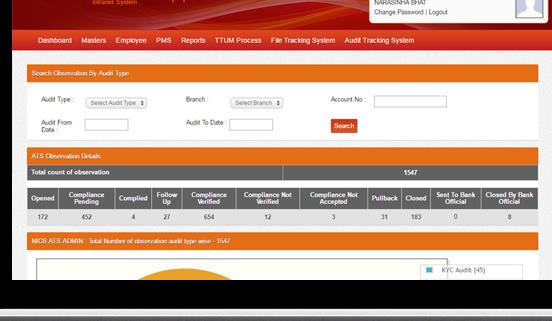

Audit tracking system

Banking - BFSI sector

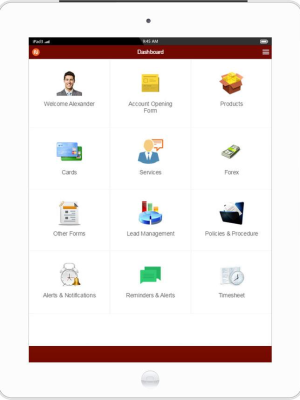

Mobile app Case study

Banking - BFSi - segment